The British Virgin Islands are one of the oldest and reputable offshore jurisdictions. The BVI company incorporation process is a simple one, with tax and confidentiality advantages for the investors.

In order to set up an anonymous company in BVI investors will need to follow the usual company formation procedure and appoint a registered agent, all along without disclosing their personal information to the public records.

The International Business Company (IBC) is the commonly used legal structure. Foreign investors have low BVI company formation requirements and enjoy a lack of corporate taxation. Moreover, investors confidentiality is valued and the beneficial owner of the company does not have to disclose his information for the purpose of registering the company. Foreign investors are welcomed and there are no restrictions regarding nationality in BVI.

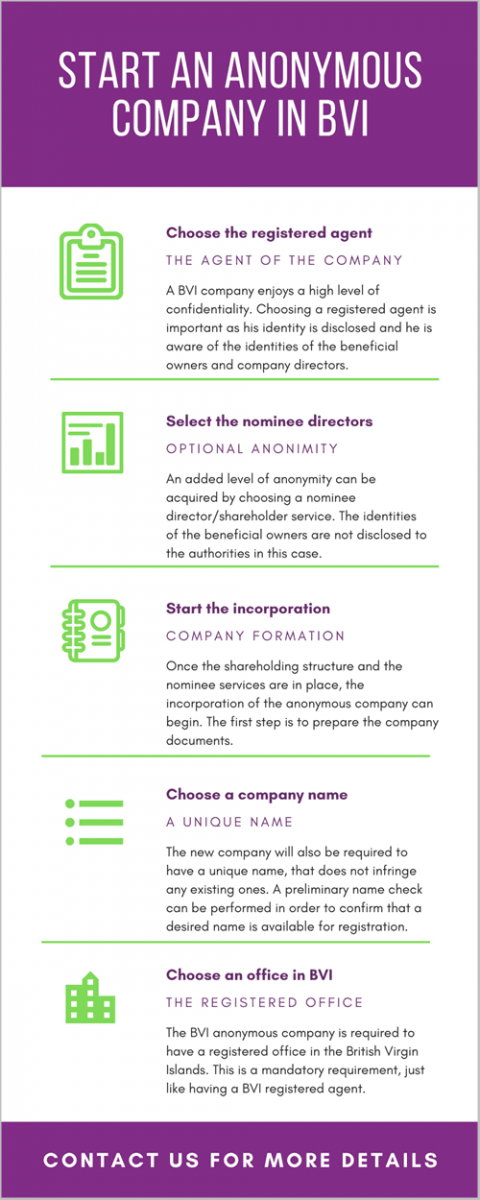

The list below highlights the main processes that allow the British Virgin Islands to maintain a high level of secrecy for investors:

The British Virgin Islands are a tax haven that is also known for its good financial privacy. This is also true for those investors interested in buying shelf companies, as the process of maintaining anonymity still applies in this case. Ready made companies are legal entities that have been incorporated as per the BVI laws but have yet to be used for commercial or trading purposes. As they have not been entered into any type of dealings or transactions, they have not incurred debts or obligations to creditors or other third parties. These companies also have their annual registration fee already paid and, depending on the date on which they are purchased, the next fee will be payable by the new owner or it will be included in the purchase price if it is due sooner than the company transfer is complete.

When buying shelf companies, it is always advisable to seek professional aid, such as the services provided by our BVI company incorporation agents. While most of the companies that are for sale are safe buys, it is recommended to perform due diligence prior to concluding the purchase agreement. The companies that are for sale also have an approved company name. Subsequent changes are possible, however, investors should expect extra costs if they choose to change the company name. Fees are also applicable to other changes to company particulars. These steps can be discussed in great detail with one of our agents.

The BVI company set up process includes a number of steps, however, this process is a simple one and can be handled remotely through our team of agents when the foreign investor cannot travel himself to the jurisdiction.

Below we briefly describe these procedures needed for incorporating in BVI:

Our team can help you draft and submit the Memorandum of Association, needed for the actual BVI company incorporation. this important constitutive document contains information regarding the name, address, scope, share capital and others. The documents will not disclose the identities of the beneficial owners. In case you would like to receive professional accounting services, we can put you in contact with our partners – Singapore-Accounting.com, who can offer a wide range of services from performing audits to payroll services.

Investing in the BVI can also mean acquiring British Virgin Islands citizenship, esentially becoming a British Overseas Territory citizen.

A BVI offshore company is used by private entrepreneurs and companies that wish to engage in activities related to financial consulting, accountancy, international trade or asset protection and management.

These companies have to observe minimal statutory requirements and this is another important reasons, apart from the high investor anonymity, why the BVI is a top offshore jurisdiction. There is no need to audit the company on a yearly basis, no annual company meetings are required and the company’s accounting documents such as the books, minutes and records can be stored in a separate location, not necessarily where the registered office is located.

The entire company formation procedure can take one to two days when all of the steps are followed. Moreover, shelf companies are just as easy to acquire, for investors who prefer this type of entering into business. Entrepreneurs who wish to buy an existing company can transfer the ownership as quickly as possible with the help of our incorporation specialists.

Our agents can help you with the BVI company set up, by following a few simple steps, starting with choosing a company name and drawing up the company documents.

Working with a local team of specialists when setting up an anonymous company (and afterward, during the course of doing business) is advisable for many different reasons. Professional and tailored legal counsel if useful before entering into new agreements, for sorting commercial and business disputes, for banking and financing matters, and more. You can talk to our lawyers in BVI for more information about our services.

The BVI International Business Company is a versatile offshore legal entity, that can be used for multiple business purposes. Many founders choose to structure their company for confidentiality purposes or for tax minimization purposes. While these two are perfectly good, there are many other uses for those interested in British Virgin Islands company formation. In many cases, the IBC is used as an investment company, meaning that it receives private funds from various portfolios or from other business ventures belonging to the founder or founders and then it is used to distribute them to other investment instruments that may be located in other countries. The particular advantage is that the funds or assets accumulated in BVI are subject to a beneficial tax regime as the jurisdiction has tax neutrality.

Another common use for a BVI offshore company is for trading purposes. More specifically, this refers to import and export activities as well as selling and distributing products. Another category may be a shipping company. Some investors will also open a BVI company for use as a holding company for property or shares in other companies as well as a company for providing professional services.

Investors should note that the British Virgin Islands are not a suitable jurisdiction for gaming activities, whether online or offline.

The fact that a BVI company can be subject to multiple uses is an important advantage for investors who decide to incorporate it here. Entrepreneurs who wish to know more about the uses of offshore companies and the conditions for engaging in some of these activities, such as providing financial services under the provisions of the Financial Services Commission, can reach out to our BVI company formation agents.

The video below highlights some of the advantages of the anonymous company:

Investors who open a company, irrespective of the chosen jurisdiction, are required to observe a set of rules and regulations for the registration and the management of that business, among others. One of these rules refers to the name of the new company and certain requirements are also in place in the British Virgin Islands.

As a general rule, the name of a BVI company should not be a misleading one. This means that it should not refer to an activity that it not, in fact, performed by the company. For example, using the words bank or insurance in the name is prohibited if the company is not properly licensed to perform these activities. Likewise, the company may not use words such as Government, Royal or Municipal, among others, also in an effort to avoid any confusion. Lastly, a proposed name is refused by the Registrar if it resembles another one in use too closely or if it infringes it.

Another issue that may be of interest to investors who choose to open a BVI offshore company is obtaining the Certificate of Good Standing. This is a document issued by the Registrar of Companies and it is an official proof that the company is lawfully incorporated. It also states that certain business complies with the administrative requirements and has paid all of the government fees. This certificate may be requested by banks after some time has passed after the registration of the business. Companies that fail to observe the rules and regulations that are in place in the British Virgin Islands will ultimately lose the status of good standing and, in the most severe cases, may be struck off or de-registered. Regarding banks, please mind that the BVI bank account opening will also require investors to provide a set of company documents.

As previously mentioned, the conditions for BVI incorporation are light ones and companies may function with a minimum presence in the Islands. This means that the registered office of the company, the one which is mandatory for incorporation, does not need to be a fully functional one. The minimum presence is ensured by a registered office and a registered agent and, when the business evolves and requires access to more services, a special package for virtual office services may be purchased as needed or as the beneficial owners of the company see fit.

An investor who wishes to act both as the company shareholder and the company director may do so if he chooses. However, this option is not the recommended solution in order to achieve the highest level of anonymity. As previously mentioned, a solution for this is to use nominee director and nominee shareholder services.

Company owners may choose to change the registered agent. This is accomplished via a formal resignation requirement, however, the law may allow for a procedure of transfer from one agent to another when no formal release is required. One of our BVI company set up agents can assist investors who are interested in changing the registered agent, irrespective of the reasons. This need may occur when the agent has been acting in bad faith.

As far as accounting is concerned, BVI companies are subject to very low requirements. While in some cases there may be a need to keep the accounting records and the supporting documentation for five years, companies are under no requirement to file the financial statements nor the annual return. The company owners do not need to arrange for annual meetings in the British Virgin Islands, they can hold these in any other location. Likewise, there is no need for audits, regardless of the size of the company. The minutes of the meetings, books and accounting documents may be stored in the BVI or elsewhere.

Investors who are interested in British Virgin Islands company formation no longer need using bearer shares. This is not to say that their use is prohibited here, as it may be in other locations, however, these are no longer useful for anonymity as the company itself allows for a satisfactory level, as previously mentioned. The bearer share will not accomplish its original task, that of allowing the holder to remain anonymous, because the beneficial owner is already disclosed to the registered agent.

As previously stated, investors may choose to use a nominee director and/or nominee shareholder services. This functions as an extra layer of anonymity, when the management of the company falls onto another individual, not the beneficial owner, who is directly appointed. The main objective of the nominee director or shareholder is to maintain the anonymity of the true owner or shareholder of the company. This may be related to tax purposes, however, there are cases in which the beneficial owner will simply wish to remain anonymous so that his involvement in a certain business will remain unbeknown to the general public.

The nominee director is not involved directly in the business matters of the BVI company. He does not make any decisions without the prior approval of the beneficial owner, with whom he has signed a fiduciary agreement. Nevertheless, the level of the nominee’s director in the company vary and it is discussed as needed. in some cases, the nominee can become part of the business activities and a co-management scheme can take place between himself and the beneficial owner. These matters are all discussed upon the incorporation of the company or prior to the commencement of the nominee director service. We recommend exercising due diligence when choosing to work with a nominee director. Only trusted individuals or companies should ever be used for this purpose.

The British Virgin Islands offers highly advantageous conditions for doing business and a high level of anonymity that is very important for some investors. All of this is made available in a beautiful setting and a location that benefits from modern infrastructure.

Below, we present a number of investment statistics for BVI:

The statistics include new business companies, private trust companies, foreign companies as well as companies that have continued to function. The data was provided by the Financial Services Commission.

Investors who open a BVI offshore company have access to a satisfactory level of anonymity and they can use their offshore structure for a number of purposes, among which providing international services or for fund management activities, among others. They also enjoy being located in an offshore jurisdiction that is a recognized one, with good banking options and low requirements for companies, along with a tax-neutral regime.

Contact us for more details about the advantages of opening an IBC in the British Virgin Islands and complete assistance for company formation.