A Forex trading license is needed by brokers and companies that intend on trading on the foreign exchange market. TThis license is required in the case of a BVI offshore company that will engage in trading currencies. Our agents can help investors obtain a BVI Forex trading license and start their trading activities as soon as possible.

| Quick Facts | |

|---|---|

| Forex broker obligation in BVI | A license is required and a BVI company must be used to apply |

|

Forex broker licence in BVI for foreign brokers |

The license is obtained through a BVI company, not individually |

|

BVI Forex licence issuing authority |

The BVI Financial Services Commission (FSC) |

| Relevant laws governing brokerage | The Securities and Investment Business Act and others |

| Special license for brokers |

As issued by the FSC |

| Laws to be observed for licensing |

The BVI Securities License requirements, as well as other laws |

| Conditions for licensing |

Meeting the capital requirements for the BVI legal entity through which the application is made |

| Management requirements |

At least two directors and one shareholder |

| On-site inspection for licensing |

Possible on a case-by-case basis |

| Application documents | Corporate documents for the company, as well as documents for the individual who will act as the broker |

| Broker dealer application fee |

$1,000 |

| Capital requirement for the BVI company |

Can start at $100,000 |

| Preliminary steps |

An initial discussion can take place with the Commission, prior to submitting the application |

| Forex broker licence issue time (approx.) |

3 months |

| Reasons to apply for a Forex broker licence in BVI | Minimum taxation, confidentiality, as well as the ability to schedule the company’s annual meetings outside BVI |

Forex trading requirements in BVI

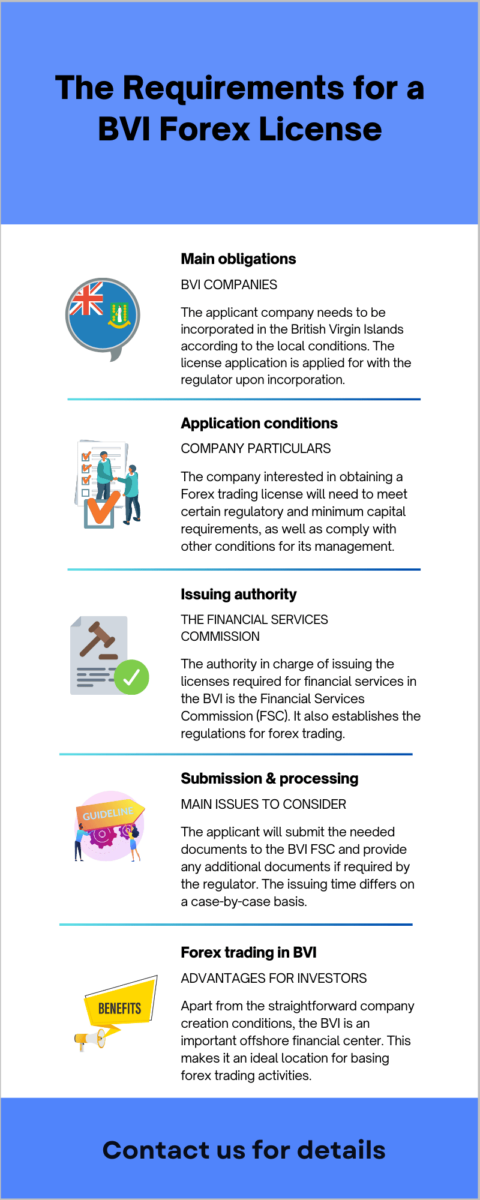

BVI companies that are involved in trading on the foreign exchange market need to apply for and operate under a Forex broker license. A few requirements are in place for this type of licensed activity and the main one is that investors will need to open a BVI offshore company. The steps are described below:

- incorporate a BVI company: the BVI company set up process is a simple one that begins with selecting an available business name.

- open a bank account: once the legal entity is incorporated, our agents can help you open a bank account in BVI.

- establish an office: companies that operate via a forex trading license are required to maintain a local office in BVI; a minimum capital is also required.

- license application: we will help you submit the license application for your company once it is registered; together with the application, a license application fee will also be paid.

Our agents can assist you throughout the licensing process. You can reach out to us to find out more about the Forex licensing requirements and fees.

Our attorneys can give you more information about the licensing laws and regulations. We provide legal services in many areas of interest and are also able to represent our clients in court or act as an attorney-in-fact. Reach out to our lawyers in BVI for information on our services concerning business law, employment regulations, intellectual property laws, real estate, litigation, and more.

Regulations for Forex trading in the BVI

The foreign exchange market is not regulated internationally, by a single or centralized regulator. This is the case because such transactions that take place on the foreign exchange market are undertaken by individual operators, who are subject to the applicable requirements in the jurisdictions where they operate. This means that a British Virgin Islands-based company that engages in Forex trading will be subject to the local regulations.

When clients choose to work with a Forex trading broker, they verify that the local licensing requirements are met. By doing so, the client makes sure that the services provider will be compliant during trading.

The BVI Financial Services Commission is the one that issues the regulations for forex trading. The Commission is the only regulatory agency that operates in the British Virgin Islands for the financial services sector. It is responsible for authorizing and licensing companies that engage in this sector.

Some of the most important requirements set forth by regulators refer to the Forex trading company’s need to have a physical office in the jurisdiction, as well as sufficient funds (of a minimum amount). The British Virgin Islands also imposes such requirements for the licenses it issues to banking, insolvency, and fiduciary services providers. Depending on the exact activities the trading company will engage in, it will be subject to a clear evaluation and the requirements dictated by the Commission.

The BVI trading company will need to meet a set of standards, as well as observe a certain conduct. Some key issues that the company needs to remain mindful of include the following:

- Security: the company and its brokers will maintain the confidentiality of their customer’s orders and their information;

- Adequate services: the company will maintain adequate resources to as to handle the client orders effectively and maintain their proper execution;

- Risk management: certain reasonable procedures must be in place to ensure that entering trading us not subject to undue financial risks;

- Integrity: maintaining the integrity of trading through adequate biding and offers, and maintain slippage within the real market conditions; trading standards are to be observed.

As part of the Financial Services Commission regulations, licensed entities in the BVI are required to observe the rules for anti-money laundering and countering the financing of terrorism.

One of our BVI company incorporation agents can help you with complete information about the ongoing requirements for forex trading licensing as expressed by the Commission.

We invite you to watch the following video on this type of licensing:

How to open a Forex company in BVI

BVI company formation is a straightforward process that can be handled by investors, including those who are unable to travel to the Islands and remain here during the entire process.

The company formation process can last a few business days and investors are advised to seek the services provided by a team of local company formation agents, such as our BVI incorporation experts.

The steps required to open a Forex company in BVI are briefly summarized by our experts:

- Choose the type of company: the International Business Company is commonly used, however, incorporating other business forms is also possible;

- Reserve the name: all companies need to have a unique business name; its availability can be checked in advance;

- Appoint the agent: the BVI company is required to have a registered agent; he will be the one to take over the preparation of the documents and the subsequent steps; this is why the appointment is made early on;

- Prepare the documents: the company’s constitutive documents, its Articles of Association, are prepared and, along with other supporting documents, are submitted to the Register;

- Post-registration: open a bank account and obtain the relevant license.

The steps above are the general ones used to register a BVI company. The licensing phase will be the distinct one for those who wish to open a Forex company in BVI.

A license issued by the BVI FSC is issued upon a proper application (using one of the approved forms), as well as the adequate supporting documents. Most applicants are asked to provide a thorough business plan, as well as filled-in forms with information on the key members of the company, along with an application fee and proof of meeting the other compliance requirements.

In some cases, it may be called for to schedule an initial appointment or discussion with the Commission. This is done for trust license applications in most cases, however, our team can evaluate your case and provide you with information on whether or not this discussion will help deal with some concerns that may be unique to the applicant in question.

Applications for licensing by the BV FSC are based on the applicant’s ability to meet the regulatory compliance requirements and meet the fit and proper criteria (among which we can mention financial soundness, integrity, and competence).

The duration of the decision phase depends on a case-by-case basis, however, the applicant should be ready to grant several weeks to this process. We recommend that interested applicants reach out to our team to receive an evaluation of their case and to have a better understanding of the documents that need to be submitted, as well as the requirements.

We remind applicants that they may commence their business operations only after the license is issued.

Our of our BVI company formation agents can act as your registered agent. This also means that we are able to handle the document preparation phase, provided that our clients send us the mandatory documents for the identification of the company shareholders and directors.

Opening a bank account takes place once the legal entity is registered with the authorities and our agents can also represent you during this stage.

You can reach out to us to find out more about the services we provide.

BVI company requirements and compliance

A company in the British Virgin Islands is subject to few reporting requirements, however, several conditions apply for its management and control.

Investors who open a Forex company in BVI observe the following requirements:

- the company will have one director, one shareholder and one registered agent;

- -the business entity will maintain a register of beneficial owners and a register of member; however, these do not need to be filed with the Registrar; the information on the beneficial owners is only disclosed under specific conditions;

- the company in BVI also needs to keep other relevant records, such as the financial ones and other relating to information about its clients; the registered agent is generally in charge of these;

- companies observe the BVI Substance Act requirements; these refer to (but are not limited to) having several physically present employees in the country, one office or more in the country, expenditure in the BVI and other requirements; non-resident companies do not adhere to the Act.

The favorable taxation conditions in the British Virgin Islands mean that:

- companies are subject to a 0% corporate income tax rate;

- the value-added tax is 0%;

- the personal income tax is 0%;

- there are no annual filing requirements.

While there are no corporate taxes, investors who open a Forex company in BVI do need to pay an annual government tax.

Employers are classified as Class 1 or 2. Class 1 needs to meet the following conditions:

- the payroll does not exceed $150,000 in a financial year;

- the annual turnover does not exceed $ 300,000;

- the company has no more than 7 employees.

Payroll tax returns and payment conditions apply.

Our team can give you more information about employment and the conditions that derive once you decide to open a Forex company in BVI.

Contact us for complete services related to British Virgin Islands company formation.