The British Virgin Islands are a popular location for basing an offshore business, particularly due to their reputation for lack of business taxation and high investor confidentiality.

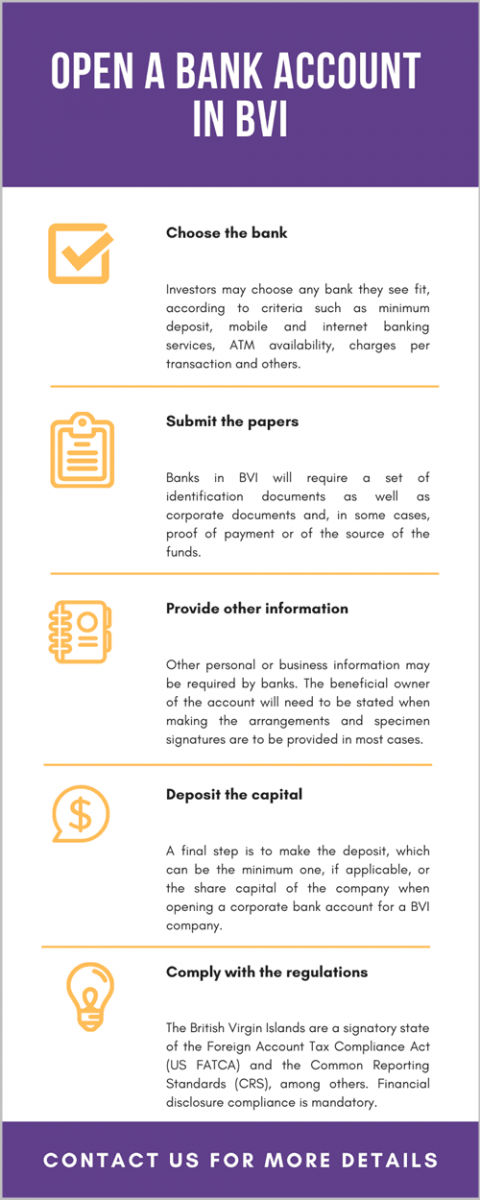

The requirements for bank accounts and banking matters are some of the most popular issues about British Virgin Islands company formation. Our team of experts answers some of the frequently asked questions on how to open a bank account in BVI in 2024.

| Quick Facts | |

|---|---|

| Mandatory local bank account for companies (Yes/No) |

No |

|

Mandatory residence requirement |

No |

|

Bank account opening time in BVI |

7-10 business days, longer in some cases |

| Online bank account opening |

Depending on the chosen bank |

| Bank accounts for foreign nationals | Yes |

| Required documents – companies |

Application form, corporate documents (certificate of incorporation, Articles of Association), proof of address in the BVI, identity documents for the appointed representative, specimen signatures and others |

| Required documents – individuals |

Application form, identification documents, proof address, FATCA documents (for US citizens, as required) |

| Special requirements for foreign nationals who open a bank account in BVI |

US citizens will need to comply with the Foreign Account Tax Compliance Act |

| Bank fees |

Monthly service fees can start at $5 Withdrawals: starting at $1.05 each after the free number available monthly Payroll fees ( for corporate accounts): starting at $20 Other fees apply, according to the chosen bank |

| Initial deposit |

Minimum amounts required to open business chequing accounts |

| Types of accounts in BVI | Corporate account, checking account, savings account, student or senior accounts depending on the chosen bank |

| Online banking | Yes, exact features depending on the chosen bank |

| Local agent requirements | Not mandatory, however, it is convenient to open a bank account in BVI through a local appointed individual (subject to conditions and additional documents) |

| Main banks |

The National Bank of the Virgin Islands FirstCaribbean International Bank VP Bank Scotiabank and others |

| Criteria for choosing the bank when you open a bank account in BVI | Type of accounts, fees, digital features, the number of ATMs and branches, whether or not the bank is an international one, etc. |

| Mobile banking | Available, with differences in options and functionality according to the chosen bank. |

|

Bank branches network |

Several branches of foreign banks. |

|

Credit facilities |

Commercial loans for businesses are available, and so are student loans, mortgage loans, and other personal loans. |

| Interest rate | Depending on the chosen bank and the type of savings account (examples include an interest of 0.05% on savings accounts for a minimum balance and over). |

| Savings account minimum balance |

Examples include a minimum opening balance of USD 2,500. |

| Personal credit cards |

Credit cards can be valid for 3 years; conditions apply according to the chosen bank. |

| Additional options for credit cards |

Revised credit card fees, interest changes, and benefits and features changes are bank-dependent. |

| Credit card payment |

Depending on the chosen bank; minimum payments may be required. |

| Other services for bank clients in BVI |

Asset management solutions, wealth planning, merchant services, and others for both individuals and businesses, depending on the chosen bank. |

| Differences for residents/non-residents | Some banks may require additional documents for non-residents. |

| International banks in BVI |

National Bank of the Virgin Islands; VP Bank (BVI); First Caribbean International Bank; Bank of Asia (BVI); First Bank Puerto Rico, etc. |

| Special rules for certain foreign citizens |

The provisions of the FATCA apply in BVI and are relevant to US citizens. |

| Bank account issues handled through a representative |

Possible through a power of attorney drawn up for specific or general purposes. |

| How we can assist you |

We answer questions about banking matters in the BVI and can act as a local representative for solving certain bank-related matters (through the aforementioned power of attorney). |

| When to contact us | If you have questions prior to opening a bank account in the BVI, or once you have an account and need local assistance. |

Does the bank account for the company need to be based in BVI?

It is not mandatory for a BVI company to open its bank account in the British Virgin Islands. The corporate bank account can be opened in another jurisdiction, as the foreign investors prefer. For some investors, opening a corporate bank account in another country may be more suitable if the business conducts most of its activities in that country or if the beneficial owners are located in that jurisdiction. In some cases, company owners who are interested in BVI company formation should take into consideration any personal tax implications that may arise from opening a bank account in one jurisdiction and operating/owning an offshore company. Understanding the local tax compliance and transparency rules in both of the jurisdictions in which the founder is doing business is important in order to avoid these issues.

The chosen bank is an important issue to consider, depending on the services for account management and, even more importantly, the associated costs. Some investors may choose to open a corporate bank account with a financial institution with which they have collaborated in the past and one that offers services that suit their needs. In case you want to open an offshore bank account in another offshore jurisdiction, we recommend our partners – Offshore-Bank-Account.co.

Our lawyers in BVI can answer any questions about bank account opening and management, the appointment of a local representative to handle banking matters, cross-jurisdiction banking, and much more. You can also reach out to our team if you have questions about legal tax implications, insolvency, intellectual property, debt collection, or employment law.

What are the documents needed for opening a BVI bank account in 2024?

The documents needed to open a bank account are different for companies compared to individuals. Companies will need to submit proof of company registration, information about the company directors including their identification documents and, in some cases, their signature specimen. When the company has more than one beneficial owner, all of them will most likely be required to provide their identification documents. The actually required documents can vary from one bank to another. Some of the main types of documents that may be required when opening a bank account in BVI include the following: the account application for, the certified copies of the director’s and shareholder’s passports or IDs, the certified copies of the BVI company, the company good standing status, the business plan and information about the company’s financial situation. Some banks may require a minimum initial deposit that can start at 1,000 USD and have different other values, as imposed by the bank. This aspect should be conformed before commencing the bank account opening procedure and it may be a criterion for selecting a particular bank over others.

Banks are subject to a set of regulations and thus in most cases, they will require the presence of the individual who opens the bank account. This means that the founder/s of the company will be required to be present at the bank when the documents for opening the account are filed. However, in some cases, the bank will accept that a representative, who holds a proper power of attorney issued specifically for this purpose, opens the account. One of our BVI company formation agents can provide additional details about how one of our specialists can act as the appointed representative for this purpose.

The process is simplified for individuals who open a bank account (that is a personal bank account, not a corporate one) as they will only need to provide the identification documents and, as needed, proof of residence or employment. Again, the regulations may differ according to the bank with which one chooses to work with.

What are the services offered for banking in BVI?

The services will depend on the chosen bank and will typically include bank account administration and management, online banking options and a range of other services, as needed. Investors should choose the bank they work with based on a few criteria, including the applicable fees and the types of services they provide to foreign investors in BVI.

How long does it take to open a bank account in BVI?

The bank will need some time to analyze the application of the client and issue the acceptance letter. This is a process that may take a few days or as long as one month. In special cases, it can last even more. However, the application process is aided if the applicant is able to properly submit all of the application documents and the requested forms as fast as possible and as requested by the bank in order to avoid any delays.

One of our BVI company formation agents can help answer any questions about banking matters for your offshore company in the British Virgin Islands.

We can also assist you if you wish to open an account after moving to the British Virgin Islands.

Bank secrecy in the British Virgin Islands

BVI is a preferred location to open an international offshore company particularly because of the favorable laws concerning banking secrecy.

Confidentiality in BVI should be understood as such as not as secrecy, as special laws are in place that guarantees compliance with the Financial Action Task Force requirements for anti-money laundering. The country has signed a number of tax information exchange agreements with various countries and has agreed to share information compliant with the requirements of these treaties or the regulations in force (namely, the Financial Action Task Force regulations). However, this does not mean that company directors do not enjoy a high level of confidentiality. Banking information is disclosed only in certain circumstances such as a proper criminal investigation. Only in this particular case do the banks in BVI provide needed information about their clients to the relevant authorities in charge of the investigation. In other cases, when not expressly allowed, the client’s information is subject to a high degree of protection and it is not divulged lightly to third parties. The names of the directors and those of the shareholders of a BVI offshore company are not publicly available. Moreover, investors may choose to use nominee director and nominee shareholder services in order to further increase their anonymity.

US investors in the British Virgin Islands are subject to the provisions of the Foreign Account Tax Compliance Act, or FATCA as it is commonly referred to. This requires that financial institutions (and non-financial ones) in countries that have adhered to this act should disclose the foreign assets held by US nationals. Some examples of foreign financial institutions that may be required to provide information on the accounts held by US nationals (namely, to forward the information to the Inland Revenue Department – IRS) include the following: banks (depository institutions), mutual funds (custodian institutions), hedge funds, private entity funds (investment entities), some types of insurance companies (with cash value products or annuities). The FATCA regulations generally exclude most governmental agencies and non-profit organizations as well as some small, local financial institutions.

One of our BVI company formation agents can provide you with complete information on the Foreign Account Tax Compliance Act and how it applies to the British Virgin Islands.

United Kingdom investors in BVI should know that a similar agreement is also in place in their case, namely the one between the Government of the British Virgin Islands and the Government of the United Kingdom to improve International Tax Compliance (UK CDOT or UK FATCA).

Other relevant provisions include those of the Common Reporting Standards (CRS) that stipulate the manner in which jurisdictions may obtain information from their financial institutions on a yearly basis. The main legal resource for the implementation of these provisions is the Guidance Notes on the Common Reporting Standards and Requirements of the Legislation Implementing the Common Reporting Standards in the Virgin Islands. One of the most recent changes also introduced a requirement for nil reporting for CRS.

BVI financial institutions need to enroll for the UK FATCA as well as the UK CDOT and the CRS using a special portal designed for this purpose. When opening a bank account in the BVI, it is common for the chosen bank to have observed the enrollment and submission deadlines.

The disclosure provisions of the aforementioned international agreements signed by the BVI are important in the context of bank secrecy. Investors should be well aware that the financial institutions they work with are subject to certain requirements. Likewise, investors who wish to open a BVI offshore company that provides financial services should be aware of the reporting requirements they will need to observe as well as the enrollment and submission provisions for the respective agreements.

Doing business in BVI

A BVI company offers a number of advantages and its beneficial owners can use the company for a number of international business activities. The BVI company set up process is a simple one, that can be accomplished fast if all of the documents are in order. The main advantages investors have when they choose to open a company here are the following:

- Very fast incorporation: a company can be incorporated as fast as one day, provided that the founders comply with the due diligence requirements.

- Low costs for incorporation: the company is not only easy to set up but the costs for incorporation remain low as there is no minimum share capital.

- No tax: BVI is one of the offshore jurisdictions with no income tax, no corporate tax, capital gains tax, wealth tax, etc.

- Confidentiality: BVI maintains a high level of confidentiality for the company directors are shareholders.

- Flexibility: investors who open a BVI offshore company can engage in many types of activities.

Our agents invite you to watch a video about opening a bank account in BVI:

The minimum number of steps required for British Virgin Islands company formation is relevant for the jurisdiction’s status. The International Business Company or the IBC can be incorporated by one shareholder and one director and the same person can fulfill both roles. Another reason why incorporation is straightforward is that there are no nationality requirements, therefore foreign entrepreneurs can register a business irrespective of their nationality.

The general incorporation process relies on a few key steps and it starts with reserving the company name for the new business. This is a common step in many jurisdictions across the world and we advise investors to prepare more than one name in advance. Once the name is reserved, the founders can appoint a registered agent. This is an important step and the agent plays an essential role in the registration of the business as well as afterwards. Our team can fulfill this role and we can provide detailed information on the general role of the registered agent in the ongoing activities of the company.

Investors will open a bank account in BVI in 2024 after they have appointed the registered agent and, as previously mentioned, our BVI company formation team is ready to assist during this step. Once the account is opened accordingly, the founders can start preparing the company documents. The documents are the Articles of Association and they include essential information on the business, its name, founders, the registered agent and other details, as needed or as decided by the founders. During this step one may opt for the nominee director services and if this is an option, our agents can provide detailed information on how to include the details of the nominee in the incorporation documents as well as how to conclude the other agreements between the appointed nominee and the beneficial owner.

As previously mentioned, there is no need to provide minimum capital upon registration, thus this this not a separate step but rather an optional one. We can provide additional information, as needed.

Investors who are interested in BVI company set up can reach out to us for complete information on the company registration timeline and how the opening of the bank account needs to be scheduled so that the process is a straightforward one.

Companies in the British Virgin Islands

Our agents have already mentioned the fact that the International Business Company (IBC) is a popular business form in this jurisdiction, given its many advantages related to minimum requirements and lack of taxation. Another legal entity type that one may take into consideration is the micro business company, registered as per the Micro Business Companies Act 2017. This new registration regime can be advantageous for some investors as it refers to businesses that have an annual turnover of no more than 2 million $ (or the equivalent in any currency) and no more than 10 employees. However, an important issue to consider about this business form is that it cannot engage in regulated business (examples include insurance, investment business, banking and fiduciary and a number of other types of services). Non regulated practitioners include accountants, auditors, legal advocates, etc.

The micro business in BVI is required to have a registered office and a registered agent. By definition, it is a company limited by shares, a separate entity from its founders, and it is registered with the BVI Register accordingly (a process after which it receives a unique registration number). It is important to note that a micro business company is cannot change its name. moreover, there are conditions for it to include the abbreviation “MBC” or the description ”Micro Business Company” in its name.

A micro business company can appoint a registered agent who has a Class I or Class II license under the Banks and Trust Companies Act or a Company Management License under the Company Management Act. One can act as agent only after he has submitted a relevant application for this purpose with the Financial Services Commission.

Our team can provide complete details on choosing a registered agent and complying with the ongoing requirements for appointing licensed service providers.

Apart from knowing the main details on BVI offshore company formation, investors are also invited to reach out to our agents for complete information on the regulatory regime set forth by the Financial Services Commission and the advantages that may be in place in selected business fields, such as the FinTech Regulatory Sandbox. An application process is in place, subject to eligibility criteria.

The British Virgin Islands are one of the most popular offshore centers, together with being a compliant jurisdiction that has not been subject to a blacklist by the Financial Action Task Force. Opening a bank account in BVI is, in most cases, part of the company formation packages and many investors are interested in setting up their accounts with a BVI bank. The following statistics applied for 2023 as per a report issued by the BVI Financial Services Commission:

- Quarterly company incorporations: 6,124 new companies in Q3, 2023, compared to 4,518 companies in Q2 of the same year; this is a 35.55% increase on a quarter-by-quarter basis; included in this total are new business companies (BCs), private trust companies, foreign companies, as well as company continuations;

- The total number of business companies on the register at the end of September (30 September) 2023 was 370.595;

- According to the type of company, most submissions were for the incorporation of a private trust company (a total of 1,137 such registrations); however, most submissions to the Registry were for company continuations (a total of 2,915 such submissions for Q3, 2023).

The British Virgin Islands offer important business advantages and a number of banking options for those who are interested in BVI company set up. Noting the important regulations for financial disclosure currently in force is important, however, for the most part, account holders are subject to a high degree of confidentiality. Opening a bank account in the Virgin Islands is a process that can take place with the help of our team. Investors who choose to have their company professionally managed should also note that they could choose between having a joint signatory or sole signatory on the company’s bank accounts.

Please do not hesitate to contact us for more information and advice on offshore companies and offshore bank accounts in the BVI in 2024.